36+ is mortgage interest tax deductable

13 1987 your mortgage interest is fully tax deductible without limits. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Web The mortgage interest deduction is an itemized deduction.

. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. However higher limitations 1. Web March 5 2022 246 PM.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Hughes a certified public.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web 3 Replies. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web Basic income information including amounts of your income. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Homeowners who are married but filing. Yes you can include the mortgage interest and property taxes from both of your homes.

From within your TaxAct return Online or Desktop click FederalOn smaller devices click in the upper left-hand corner then click. Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. Web But for loans taken out from Dec.

Web According to the tax code this homeowners deductions for mortgage interest and property taxes would be evaluated at a 15 percent marginal tax rate. 15 2017 onward only the interest on the first 750000 of mortgage debt is deductible says William L. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

If you have a smaller mortgage or have almost paid off your mortgage the standard deduction could. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately.

Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat. A borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income. Double-check in the mortgage interest section of your return that you did indicate that the interest is secured by a property that you own.

But for loans taken out from. Taxes Can Be Complex. The interest on an additional.

Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. For taxpayers who use.

Web Home mortgage interest. Web To enter mortgage interest. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

However the deduction for mortgage interest. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web If youve closed on a mortgage on or after Jan.

Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married. Homeowners who bought houses before. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web Mortgage interest. Web Tax Deductible Interest. Taxes Can Be Complex.

Ad See how income withholdings deductions credits impact your tax refund or owed amount. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return. Web To enter mortgage interest in the TaxAct program go to our Form 1098 - Entering in Program FAQ.

Web Is Mortgage Interest Tax Deductible in 2022 and 2023. Per IRS Publication 936 Home Mortgage Interest Deduction page 2. TaxAct has a deduction maximizer to help find other potential deductions.

Types of interest that are tax. Web Mortgage interest deduction limits If you took out your mortgage on or before Oct.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Bankrate

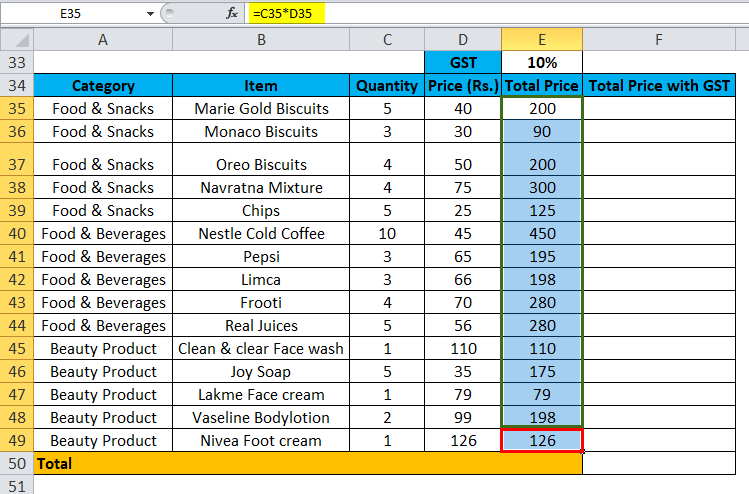

Absolute Reference In Excel Uses Examples How To Create

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Tax Assessment How Property Taxes Are Determined

Proptech Study By Proptech Switzerland Issuu

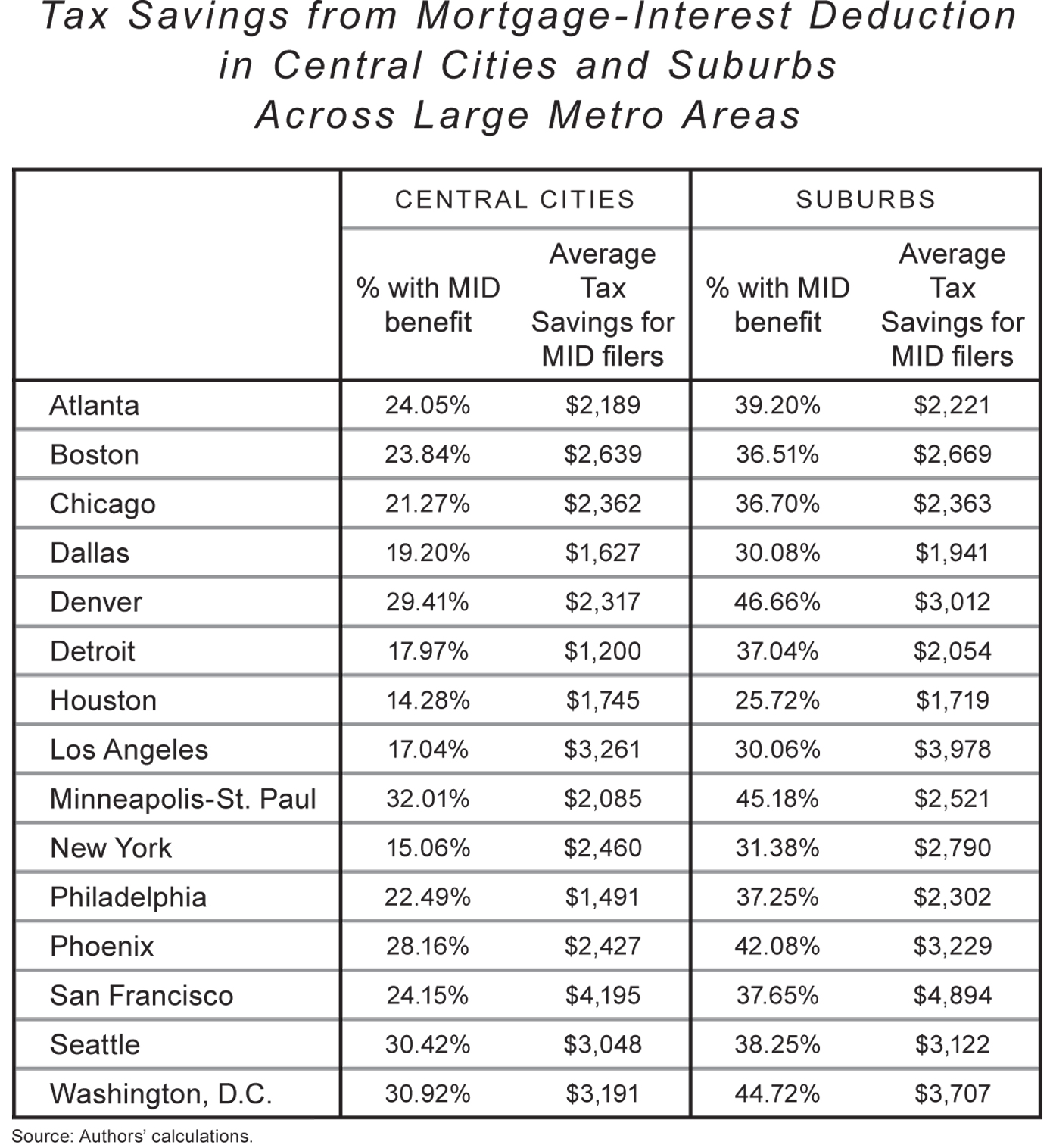

Rethinking Tax Benefits For Home Owners National Affairs

Maximum Mortgage Tax Deduction Benefit Depends On Income

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Efaso Remote Controlled Car 9135 Monster Truck 36 Kmh Fast 1 16 Rc Car With Strong Motor Metal Gearbox Water Splashproof Offroad And Off Road Suitable Amazon De Toys

Mortgage Interest Tax Deduction Smartasset Com

The Home Mortgage Interest Deduction Lendingtree

American Economic Association

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Maximum Mortgage Tax Deduction Benefit Depends On Income

Coronavirus Finance Bills Help

Mortgage Interest Deduction How It Calculate Tax Savings